more money for the things that matter

We'll help you refinance so that you have more time & money

for

fun on the slopes.

home improvements.

the kids sports.

a rainy day.

college fees.

the important things.

Spend life living, leave the work to us.

A REFINANCE THAT WORKS FOR YOU

Heard it’s a refinancer’s market but not sure what that means for you?

It’s hard to know the ins and outs of getting the best rate and calculating how much you can save in the process.

That’s why we’re here! As Independent Mortgage Brokers, we have access to more lenders with the lowest rates in the market, as well as 27 years of experience making refinancing work for your goals.

Our clear, simple, and strategic process will give you the information you need to make great decisions to help you maximize the potential benefits of refinancing for you and your family.

a perfect match

We’re the perfect fit to help with your refinancing if you live in California and…

YOU NEED LIQUIDITY NOW AND WANT TO MAKE SMART DECISIONS FOR YOUR FUTURE

Harness the investment you have already made in your home to find funds for other investments in your life.

YOU WANT TO SAVE MONEY ON MONTHLY PAYMENTS

Rearrange your term to lower your payments and use that extra money for the things that matter.

YOU’RE HUNTING FOR THE BEST RATES and products THAT FIT YOUR NEEDS

Everyone has a different goal in their refinance. Whether it be cash-out, lower rate, or more affordable payments, let us structure a refinance that meets your goals.

We make it easy to start your refinance today, no wait necessary

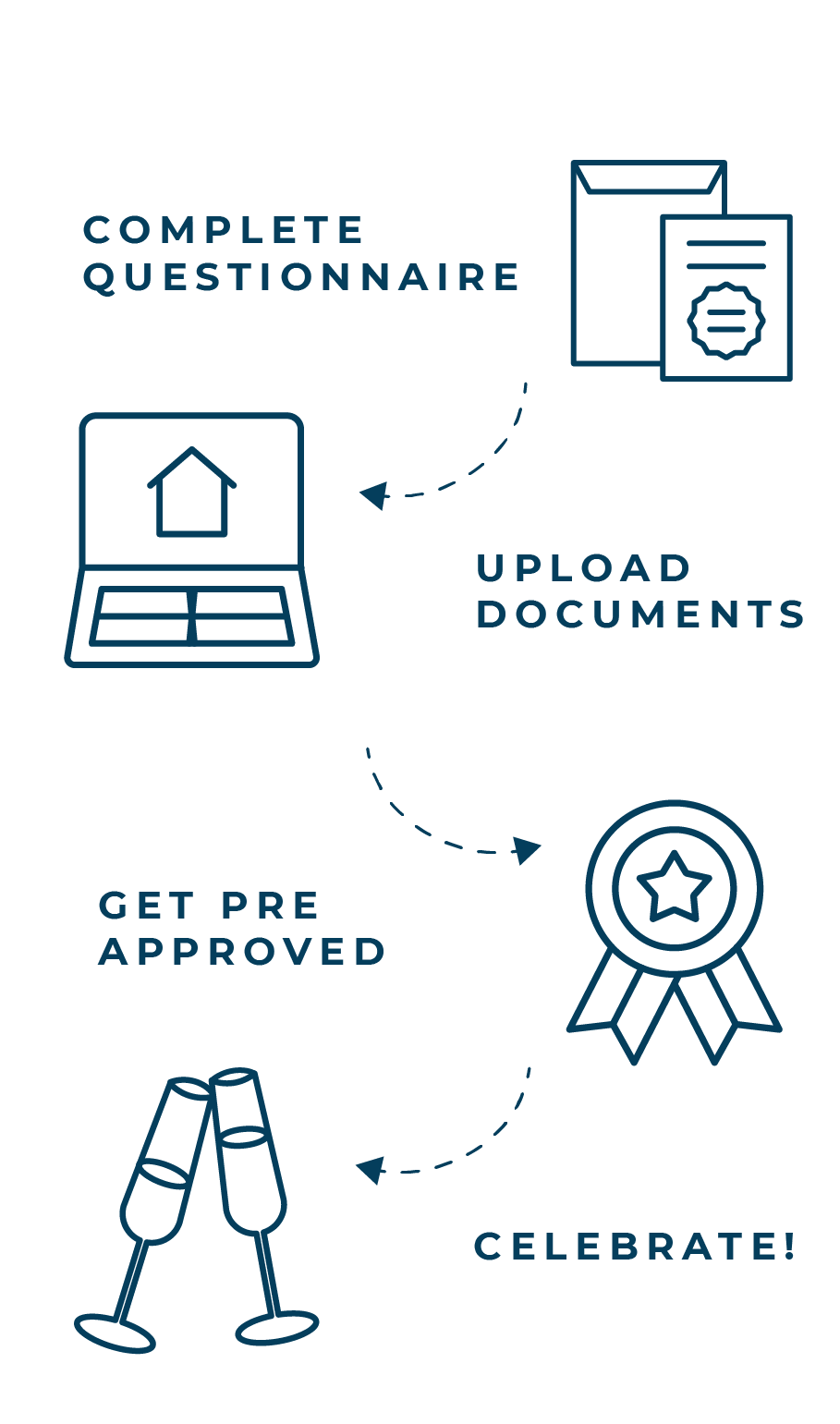

How it works

Our seamless refinance process

Complete Application

Upload documents

Get pre approved

celebrate!

frequently asked questions about refinancing

-

You can benefit from refinancing by consolidating your debt and paying off your Mortgage, Home Equity Line, Credit Cards and Auto Loans. If your goal in refinancing is payment relief, we can look to retire your current debt in a way that makes sense to bring down your overall payment per month.

-

There are loan programs for credit scores of all ranges. For standard loans $647,200 and under the minimum credit score is 580. Loans larger than $647,200 (Jumbo Loans) require a minimum credit score of 680. If your credit score falls outside of the 580 minimum, don't worry, there are still plenty of options for you. Contact us today.

-

The cost of refinancing depends a lot on your loan amount, but as a general rule the total cost for a refinance (including but not limited to title, escrow, processing, underwriting, credit report, notary, recording, etc.) on a $500,000 loan amount is approximately $3800- $4200 exclusive of appraisal fee.

-

Based upon the type of loan program you choose, the lender will allow you to take a maximum amount of cash out of your property. An example is 80% of the value of your home. Based upon an estimate of your appraised value, your Loan Officer will let you know approximately how much cash you can expect to receive at closing.

-

The refinance process is a simple, straightforward and streamlined with us. Apply online upload some documents, and your loan approval will be delivered to you in a matter of days! Once we secure an appraisal inspection, we can close in 21-25 days.

-

The list of paperwork includes:

-Paystubs covering the most recent 30 days

-Last two years Federal tax returns

-Last two years W-2s, 1099s or K-1s from your taxes

-Paystubs covering one month

-Last two month’s most recent statements

-Assets: bank accounts, IRA, 401K, Stock

-Legible copy of your Drivers License or Passport